Financial Services Regulatory Law Litigation Trends reflect industry evolution, with RF Finance law firms navigating complex data privacy, anti-money laundering, and securities regulations globally. They shape financial services future through high-stakes trials, catering to startups to institutions while promoting innovation and ethical practices. Dynamic industry drives rapid changes, with regulatory bodies using advanced analytics for precise investigations, emphasizing compliance and enforcement actions for consumer protection and market integrity. In the digital age, firms must enhance data security measures to safeguard client information. Adapting to trends is crucial for success in specializing in fintech and blockchain, navigating cross-border transactions, and maintaining competitive edges.

“In the dynamic realm of RF Finance, understanding the intricate dance between law and financial services is paramount. This article explores the evolving landscape of Financial Services Regulatory Law, shedding light on emerging litigation trends that shape industries. From compliance and enforcement actions to escalating data privacy concerns, we navigate the challenges. By analyzing these factors, we uncover opportunities for growth, ensuring RF Finance law firms remain ahead in an era defined by regulatory shifts and technological advancements.”

- Financial Services: Regulatory Law Landscape

- Emerging Trends in Litigation

- Compliance and Enforcement Actions

- Data Privacy and Security Concerns

- Future Challenges & Opportunities

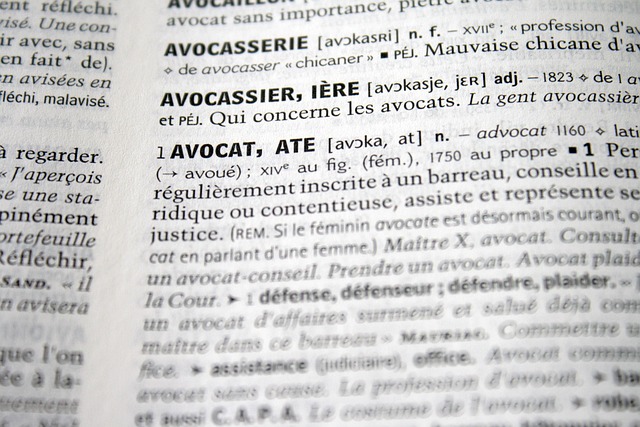

Financial Services: Regulatory Law Landscape

The landscape of Financial Services Regulatory Law is a complex web where litigation trends reflect evolving industry standards and consumer protections. RF Finance Law Firms, at the forefront of this domain, navigate this intricate regulatory environment to achieve extraordinary results for their clients. They guide businesses through a dynamic legal framework that includes stringent rules on data privacy, anti-money laundering, and securities trading, ensuring compliance with both domestic and international laws.

These law firms play a pivotal role in shaping the future of financial services by representing clients in high-stakes jury trials, addressing disputes within the rapidly changing digital banking landscape. Their expertise extends to serving diverse interests, from tech startups to established institutions, fostering innovation while upholding ethical practices. Moreover, their engagement with philanthropic and political communities underscores their commitment to not just legal excellence but also responsible financial governance.

Emerging Trends in Litigation

The landscape of Financial Services Regulatory Law Litigation is evolving rapidly, driven by emerging trends that reflect the dynamic nature of the financial sector itself. One notable trend is the increasing complexity of regulatory actions against both corporate and individual clients accused of white-collar and economic crimes. As regulatory bodies become more sophisticated in their investigations, they are employing advanced analytics and data mining to uncover potential violations, leading to more targeted and aggressive litigation strategies.

This shift has profound implications for law firms serving the RF Finance sector. To remain competitive, these firms must adapt by enhancing their expertise in white-collar defense and developing innovative approaches to represent clients across a wide range of financial services industries. Staying abreast of legislative changes and regulatory interpretations is crucial, as is fostering a culture that encourages proactive risk management and compliance strategies among their corporate and individual clients.

Compliance and Enforcement Actions

Compliance and Enforcement actions have become increasingly significant within the Financial Services Regulatory Law landscape, particularly in recent years. With a growing emphasis on consumer protection and market integrity, regulatory bodies are leveraging litigation trends to send strong signals and uphold the highest standards across industries. This proactive approach extends beyond traditional general criminal defense mechanisms, as regulators delve into complex cases involving fraud, money laundering, and other financial crimes.

The impact of these actions resonates far and wide, not only within the legal community but also among the philanthropic and political communities. The unprecedented track record of successful prosecutions serves as a testament to the evolving regulatory landscape, where compliance is no longer an optional consideration but a fundamental requirement for businesses operating in the financial sector.

Data Privacy and Security Concerns

In today’s digital age, financial institutions and law firms handling sensitive client data face heightened data privacy and security concerns. With the rise of Financial Services Regulatory Law and Litigation Trends, protecting confidential information from cyber threats and unauthorized access has become a paramount challenge. Law firms serving RF Finance companies must implement robust security measures to safeguard not only their clients’ data but also to avoid indictment for data breaches. High-stakes cases often hinge on achieving extraordinary results through effective risk management and privacy protections.

The intricate nature of financial transactions and the stringent regulatory environment necessitate a meticulous approach to data handling. Law firms playing a pivotal role in this sector must stay abreast of evolving litigation trends, ensuring they are equipped to address not only current challenges but also anticipate future legal developments in data privacy and security. By prioritizing these concerns, RF Finance law firms can maintain client trust and ensure their operations remain compliant with the ever-changing regulatory landscape.

Future Challenges & Opportunities

The evolving landscape of financial services presents both challenges and opportunities for RF Finance Law Firms. As regulatory law litigation trends continue to shift, firms must adapt and innovate to stay ahead. One of the primary challenges lies in keeping pace with increasingly complex and intricate regulatory frameworks, which demand a deep understanding of market dynamics and global trends.

Moreover, navigating the intricacies of cross-border transactions and data privacy regulations is a significant hurdle. However, these challenges also offer opportunities for growth and differentiation. By specializing in emerging areas like fintech and blockchain technology, firms can provide cutting-edge solutions to clients. Winning challenging defense verdicts and achieving extraordinary results in complex cases strengthens their reputation and positions them as leaders in the respective business. This, in turn, fosters trust and attracts a wider range of financial institutions seeking expert guidance in navigating the ever-changing regulatory environment.

RF Finance law firms play a pivotal role in navigating the dynamic landscape of financial services regulatory law. By staying abreast of emerging litigation trends, compliance expectations, and data privacy concerns, these firms empower clients to anticipate challenges and capitalize on opportunities. As the industry continues to evolve, their expertise ensures that businesses operate within legal parameters, fostering a sustainable and secure financial environment.